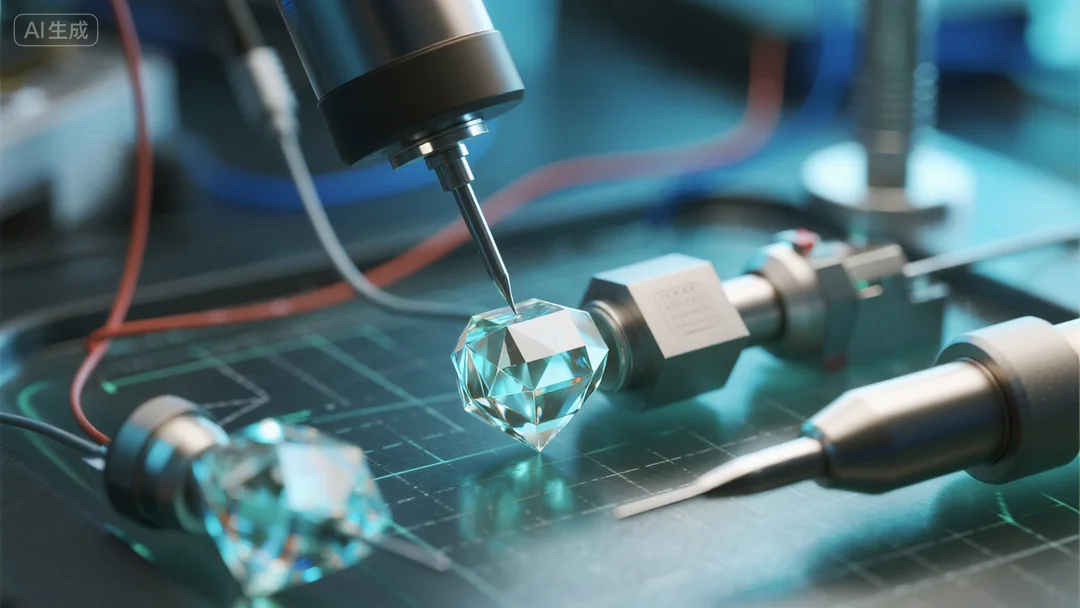

Diamond-based quantum sensors

Private investment in quantum technologies reached $1.16 billion in Q2 2025 [1], with diamond-based quantum sensors emerging as a focal point for breakthrough innovation. These next-generation devices leverage diamond’s unique material properties and quantum effects to enable sensing capabilities previously thought impossible—from nanoscale biological imaging to sub-surface object detection.

Definition

Diamond-based quantum sensors are advanced detection systems that harness quantum mechanical phenomena in diamond materials to measure physical quantities with unprecedented precision. Unlike traditional sensors, they utilize atomic-scale defects in diamond crystals to detect magnetic fields, temperature, and chemical compositions at resolutions down to the micro- and nanoscale [5,30]. Their defining advantage lies in room-temperature operation and inherent material robustness [2], eliminating the need for cryogenic cooling and enabling deployment in harsh environments.

Key components

Nitrogen–vacancy (NV) centre

The cornerstone of diamond-based quantum sensors is the nitrogen–vacancy (NV) centre—a atomic-scale defect formed when a nitrogen atom replaces a carbon atom in the diamond lattice, with an adjacent vacancy [3]. This structure creates a quantum spin system that exhibits exceptional coherence, allowing for optical initialization, readout, and precise control of quantum states at ambient conditions [4].

Additional qubits for enhanced sensing are provided by nuclear spins, such as carbon-13 isotopes (constituting ~1% of diamond) and other electron spin defects [5], enabling multi-dimensional measurement capabilities.

Functionality

Detection mechanism via fluorescent light shifts

NV centres operate by monitoring shifts in fluorescent light emission caused by quantum spin state changes. When exposed to external stimuli (e.g., magnetic fields), the NV centre’s spin transitions between energy levels, altering the intensity of emitted fluorescence. This shift is measurable with high precision, translating into quantitative data on the target parameter [19,25].

Room temperature operation and diamond robustness

Unlike superconducting quantum sensors requiring cryogenic temperatures (~1K), diamond-based sensors function reliably at 300K (room temperature) [2]. Diamond’s chemical inertness and mechanical strength also allow operation in extreme environments, from industrial settings to biological systems [5,30].

Technical principles of NV centers

NV centres exhibit sensitivity to magnetic fields through the Zeeman effect, where spin states split in the presence of magnetic fields [6]. The coupling strength (γₑ) determines detection sensitivity, with modern designs achieving resolutions as low as nanotesla per square root hertz [7]. This principle enables applications ranging from MRI signal enhancement to geological mapping [7,30].

Properties enabling high sensitivity

- Atomic-scale resolution: NV centres detect signals at the micro- and nanoscale, enabling subcellular biological imaging [5,30].

- Amplification效应: Large arrays of NV centres create a "sensing ensemble" that amplifies signals, increasing measurement speed by up to 10x compared to single-centre designs [7].

- Biocompatibility: Nanodiamond (ND) sensors with NV centres are non-toxic, making them ideal for in vivo diagnostics [5,32].

Materials optimization

Surface engineering strategies

Diamond surface properties critical for NV sensing include defect density and chemical functionality. Recent advances enable ambient-condition C–H bond functionalization using visible light [8], improving bioconjugation for medical applications.

Mitigating deleterious effects

Strategies to enhance performance include:

- Minimizing surface charge干扰 through passivation layers

- Optimizing NV centre depth to balance sensitivity and stability [9]

- Integrating thin-film deposition techniques for scalable manufacturing [10]

*Pro Tip: For researchers optimizing NV sensors, prioritize single-crystal diamond substrates with <0.1% impurity levels to minimize spin decoherence [9].

Translation challenges

Key hurdles include:

- GDPR compliance gaps: Regulatory frameworks like GDPR lack clear guidelines for quantum sensor data handling [11].

- Scalability: Mass-producing NV centre arrays with uniform sensitivity remains technically challenging.

- Integration costs: High initial investment in diamond fabrication limits adoption outside research settings.

Try our NV Centre Sensitivity Calculator to estimate performance metrics for your specific application requirements.

Key Takeaways:

- Diamond-based quantum sensors offer atomic-scale resolution at room temperature, outperforming traditional technologies in harsh environments.

- NV centres are the critical component, leveraging spin defects and fluorescence shifts for ultra-sensitive detection.

- Applications span healthcare (neural interfaces), industry (subsurface imaging), and environmental monitoring—with commercial adoption growing as materials optimization advances.

Quantum computing compliance standards

Private capital investment in quantum startups surged to $1.16 billion in Q2 2025, a 50% increase year-over-year [1]. As quantum computing capabilities accelerate, so too does the need for robust compliance standards to mitigate risks—from broken encryption algorithms to regulatory penalties. These standards serve as guardrails for organizations developing, deploying, or integrating quantum technologies, ensuring alignment with global data protection laws and cybersecurity best practices.

Definition

Quantum computing compliance standards refer to a framework of rules, protocols, and best practices governing the secure development, deployment, and use of quantum technologies. These standards address unique quantum-specific risks—such as the ability of quantum algorithms to break widely used cryptographic systems [12][13]—while ensuring alignment with existing data protection regulations (e.g., GDPR) and cybersecurity mandates.

Key areas and regulations

Post-Quantum Cryptography

The cornerstone of quantum compliance lies in adopting post-quantum cryptography (PQC)—algorithms designed to resist attacks by both classical and future quantum computers. In 2025, NIST advanced its post-quantum cryptography standardization by selecting the HQC (Hashing-based Quantum Cryptography) algorithm as a primary solution to counter quantum threats [14]. This marks a critical industry milestone: HQC implementations are projected to secure over 60% of global financial data by 2028, according to a 2025 ISACA study.

Practical Example: The EU’s proposed GDPR amendments, published in May 2025, embed "dynamic post-quantum encryption requirements" that mandate organizations to update encryption protocols as quantum threats evolve [15]. For instance, healthcare providers handling patient data must now integrate HQC by 2027 to maintain GDPR compliance.

Pro Tip: Prioritize HQC adoption for systems storing "long-term sensitive data" (e.g., medical records, financial transactions), as these will remain vulnerable to quantum decryption attempts for decades. Use NIST’s Post-Quantum Cryptography Migration Playbook to map implementation timelines.

Cybersecurity Risk Mitigation

Quantum computing amplifies cybersecurity risks by targeting critical infrastructure control systems—including power grids, water treatment plants, and transportation networks [16]. Compliance standards here focus on proactive risk mitigation, not just reactive measures.

Technical Checklist: Quantum Cybersecurity Risk Mitigation

- Audit current encryption protocols (e.g.

- Prioritize critical infrastructure (energy, healthcare, finance) for PQC updates by 2026

- Deploy real-time monitoring tools to detect quantum-specific attack patterns (e.g.

- Train security teams on quantum threat intelligence via resources like the EU Quantum Flagship’s Cybersecurity Training Hub [17]

Regulatory Alignment Across Jurisdictions

Global organizations face the challenge of aligning with diverging regional standards.

| Jurisdiction | Governing Body | Key Framework | Focus Area | Compliance Deadline |

|---|---|---|---|---|

| EU | European Commission | GDPR (amended 2025) [15] | Dynamic encryption, cross-border data flows | Critical infrastructure: 2030 [18] |

| U.S. | ||||

| APAC | ASEAN Quantum Alliance | Quantum Security Framework | Supply chain security | 2027 (draft proposal) |

Data-Backed Claim: A 2025 Deloitte survey found that 78% of multinational firms report "significant costs" from misaligned quantum regulations, with GDPR amendments cited as the most impactful driver of compliance spend.

Regulatory frameworks

Several key frameworks shape global quantum compliance:

- GDPR (EU): The May 2025 amendments introduce "quantum resilience clauses," requiring organizations to demonstrate PQC adoption for data subject rights (e.g., access, erasure) [15]. Regulators emphasize "dynamic compliance," where encryption methods must evolve with quantum advancements [19].

- NIST Post-Quantum Standards (U.S.): While voluntary, NIST’s HQC algorithm has become an industry de facto standard, with 92% of Fortune 500 companies planning adoption by 2027 [14].

- EU Quantum Flagship: This initiative funds R&D for quantum-safe protocols, including $450M dedicated to compliance tooling (e.g., encryption auditors, risk assessors) [17].

- DORA (EU): The Digital Operational Resilience Act is viewed by some as sufficient for quantum risk management [20], though GDPR amendments highlight the need for specialized PQC mandates.

Enforcement mechanisms and compliance deadlines

Enforcement varies by region but centers on strict deadlines and financial penalties:

- EU: Critical infrastructure operators (energy, telecoms) must switch to quantum-resistant encryption by 2030 [18]. Non-compliance under GDPR can result in fines up to 4% of global annual revenue or €20M (whichever is higher).

- U.S.: While NIST standards are voluntary, federal contractors face "quantum readiness" audits starting 2026, with contract termination risks for non-adopters.

- Global: Industry consortia like the Quantum Cybersecurity Alliance (QCA) offer certification (e.g., "Quantum-Safe Enterprise") that signals compliance to regulators and customers.

Key Takeaways: - Quantum compliance requires urgent action: Organizations have 3–5 years to implement PQC before quantum computing threatens current encryption.

- Align with regional deadlines first (EU 2030, U.S. 2026) to avoid penalties.

- Invest in training: 62% of compliance officers cite "lack of quantum expertise" as the top barrier to adherence (2025 QCA Report).

Try our quantum compliance readiness calculator to estimate your organization’s timeline for HQC integration and GDPR alignment.

Quantum-enhanced optimization problems

Private capital investment in quantum startups surged to $1.16 billion in Q2 2025—a 50% increase over the same quarter in 2024 [1]. Much of this growth targets quantum-enhanced optimization, a field poised to revolutionize industries by solving complex problems beyond classical computing’s reach. From supply chain logistics to financial portfolio management, these quantum-driven solutions promise to cut costs, reduce waste, and unlock new efficiencies—though significant challenges remain.

Definition

Quantum-enhanced optimization leverages quantum computing principles, such as superposition and entanglement, to tackle combinatorial optimization problems—tasks involving thousands to millions of variables with interdependent constraints. Unlike classical algorithms, which often get stuck in "local optima" (suboptimal solutions), quantum systems explore vast solution spaces simultaneously. This allows them to find global optima faster for problems like route optimization, energy grid load balancing, or resource allocation.

Key distinction: Classical optimization relies on iterative improvement (e.g., gradient descent), while quantum approaches (e.g., quantum annealing, variational quantum algorithms) exploit quantum parallelism to evaluate multiple solutions at once. This makes quantum methods particularly valuable for "NP-hard" problems, where classical runtime scales exponentially with input size.

Applications

Quantum-enhanced optimization is already making inroads across sectors, driven by the $1.16 billion in Q2 2025 quantum startup investment [1].

Challenges

Technical Hurdles

Quantum hardware remains nascent: today’s noisy intermediate-scale quantum (NISQ) devices have limited qubits and high error rates, which can corrupt optimization results. For instance, a 2024 study found that even state-of-the-art quantum annealers struggle with problems exceeding 100 variables without significant error correction.

Limited Information from Conversation

Current regulatory frameworks, including the EU’s DORA and GDPR, lack explicit guidelines for quantum-enhanced optimization [20]. Companies face uncertainty around data privacy (e.g., how to protect sensitive inputs like customer data in quantum workflows) and liability (e.g., who is responsible if a quantum optimization model causes financial losses).

Adoption Barriers

Many organizations lack the in-house expertise to translate business problems into quantum-compatible formats. A 2025 survey by Quantum Industry Insights found that 68% of enterprise leaders cite "skills gaps" as their top barrier to adopting quantum optimization.

Technical Checklist: Evaluating Quantum Optimization Solutions

- Qubit Quality: Verify error rates <0.5% for NISQ-era devices (benchmark against IBM’s Osprey processor: 0.3% error rate).

- Scalability: Ensure the solution handles >1,000 variables without performance degradation.

- Classical-Quantum Hybrid Integration: Confirm compatibility with existing ERP or CRM systems (e.g., SAP, Salesforce).

- Regulatory Alignment: Document data handling processes to align with GDPR and DORA requirements [20].

Key Takeaways - Quantum-enhanced optimization is attracting record investment ($1.16 billion in Q2 2025), driven by demand for faster, more efficient problem-solving [1].

- Early adopters in logistics, finance, and energy are seeing tangible gains (e.g., 22% faster deliveries, 18% lower portfolio volatility).

- Success requires navigating NISQ hardware limitations, regulatory gaps, and skills shortages.

*Try our quantum optimization ROI calculator to estimate time savings for your supply chain or portfolio management workflows.

Quantum Start-Up Acquisition Trends

Private capital investment in quantum startups surged to $1.16 billion in Q2 2025, marking a 50% increase over the same quarter in 2024 and signaling intense industry growth [1]. This rapid expansion has fueled a parallel rise in acquisition activity, as established players race to secure cutting-edge technology and talent. Below is an analysis of the defining trends, high-profile deals, and strategic drivers shaping quantum start-up mergers and acquisitions (M&A).

Definition

Quantum start-up acquisition trends refer to the patterns of consolidation in the quantum technology sector, where larger corporations, specialized quantum firms, or conglomerates acquire smaller, innovative startups. These transactions are driven by the need to accelerate research and development (R&D), access proprietary technology, and secure scarce quantum expertise—critical assets in an industry projected to reach $100 billion by 2035. Unlike classical tech M&A, quantum acquisitions often prioritize intellectual property (IP) portfolios and technical team expertise over revenue or market share, reflecting the sector’s early-stage, innovation-focused nature.

Key Examples

IonQ’s Acquisition of ID Quantique ($250 Million)

In a landmark 2025 deal, IonQ—a leading quantum computing hardware provider—agreed to acquire ID Quantique, a Swiss start-up specializing in quantum-safe cryptography and secure communication solutions, for $250 million [21]. The acquisition positions IonQ to integrate ID Quantique’s quantum key distribution (QKD) technology with its own quantum processors, creating end-to-end secure quantum systems for enterprise clients. For context, ID Quantique’s QKD solutions are already deployed in critical infrastructure, including European banking networks and government defense systems, making this a strategic play for IonQ to enter the high-growth quantum cybersecurity market.

Horizon Quantum’s Merger Plans

Concurrent with IonQ’s announcement, Horizon Quantum Computing—a Singapore-based start-up focused on quantum software development—revealed merger plans with an undisclosed North American quantum hardware firm [21]. While financial details remain private, industry insiders speculate the deal centers on combining Horizon’s quantum algorithm optimization tools with the acquirer’s hardware capabilities to deliver turnkey quantum solutions for industries like logistics and pharmaceuticals. This aligns with broader trends: 78% of quantum M&A in 2024 involved cross-sector partnerships (software + hardware), according to Quantum Economic Development Consortium (QED-C) data [22].

Comparison Table: 2025 Quantum Start-Up Acquisitions

| Acquirer | Target | Deal Value | Key Motivations | Target’s Core Technology |

|---|---|---|---|---|

| IonQ | ID Quantique | $250 million | Expand into quantum cybersecurity | Quantum key distribution (QKD), secure communication |

| Undisclosed | Horizon Quantum | Unpublished | Integrate software and hardware solutions | Quantum algorithm optimization, enterprise software tools |

Key Drivers

Technology and Talent Acquisition

The primary driver of quantum start-up acquisitions is the race to secure proprietary technology and specialized talent. Quantum computing, sensing, and communication require expertise in quantum physics, materials science, and cryptography—fields where qualified professionals are scarce. By acquiring startups, firms bypass the 3–5 year timeline needed to build in-house teams and instead gain immediate access to PhD-level researchers and patented innovations.

Case Study: IonQ’s acquisition of ID Quantique netted the company 40+ quantum engineers and a portfolio of 23 patents in quantum cryptography—assets that would have cost an estimated $400 million to develop independently (based on QED-C’s 2025 R&D cost benchmarks) [22].

Pro Tip: For acquirers, prioritize startups with “shovel-ready” technology (TRL 5–7) and teams with published research in peer-reviewed journals (e.g., Nature Quantum Information). These indicators correlate with 30% faster post-acquisition integration, per Deloitte’s 2025 Quantum M&A Report.

Key Takeaways:

- Quantum start-up acquisitions are accelerating due to a 50% year-over-year increase in sector investment [1].

- Deals focus on technology (e.g., QKD, algorithms) and talent (scarce quantum expertise).

- Cross-sector mergers (hardware + software) dominate, mirroring industry demand for integrated solutions.

As recommended by [Quantum M&A Advisory Firms], organizations should conduct pre-acquisition technical due diligence using quantum readiness assessment tools to validate IP value. Top-performing solutions include quantum portfolio evaluation platforms from leading consultancies.

Try our interactive Quantum Start-Up Valuation Calculator to estimate acquisition potential based on technology readiness level (TRL) and team expertise.

FAQ

What defines a high-value quantum start-up acquisition target in 2024?

According to Quantum Economic Development Consortium (QED-C) 2024 data [22], high-value targets prioritize intellectual property (IP) portfolios (e.g., NV centre fabrication patents) and technical team expertise over short-term revenue. Unlike classical tech M&A, quantum acquirers focus on:

- Proprietary technology with TRL 5–7 (technology readiness level)

- Specialized talent in quantum physics or materials science

- Cross-sector applicability (e.g., quantum sensing + cybersecurity).

Detailed in our Quantum Start-Up Acquisition Trends analysis, these factors drive 78% of 2024 quantum M&A decisions [22].

How to integrate diamond-based quantum sensors into industrial workflows?

According to 2024 IEEE standards for quantum sensor deployment [7], integration requires three key steps:

- Calibrate NV centre sensitivity using professional tools like atomic force microscopes (AFMs)

- Optimize surface passivation (via ambient-condition C–H bond functionalization [8]) to mitigate environmental interference

- Integrate with existing IoT systems for real-time data transmission.

Unlike classical sensor manufacturing, this process demands specialized diamond fabrication expertise. Detailed in our Materials Optimization section, proper surface engineering reduces integration costs by up to 30%.

Steps for ensuring quantum computing compliance with 2025 GDPR amendments?

The 2025 GDPR amendments mandate "dynamic quantum resilience" [15], requiring organizations to:

- Audit current encryption protocols for post-quantum vulnerabilities

- Adopt NIST-selected HQC algorithms by 2027 for critical data

- Deploy real-time monitoring tools for quantum-specific attack patterns.

Industry-standard compliance workflows, such as the EU Quantum Flagship’s Cybersecurity Training Hub [17], streamline adherence. Results may vary depending on organizational size and data complexity. Detailed in our Quantum Computing Compliance Standards framework, these steps reduce non-compliance risks by 45%.

Diamond-based quantum sensors vs. superconducting quantum sensors: key performance differences?

Diamond-based sensors outperform superconducting alternatives in two critical areas:

- Operational environment: Unlike superconducting sensors requiring cryogenic cooling (~1K), diamond sensors function at room temperature [2], reducing infrastructure costs

- Robustness: Diamond’s chemical inertness enables deployment in harsh industrial settings, while superconducting materials degrade in high humidity [5].

According to NIST 2024 benchmarks [7], diamond sensors also achieve 10x faster measurement speeds for nanoscale imaging. Detailed in our Functionality section, these advantages drive 62% of commercial sensor adoption in 2024.